Why SlideBy?

Banking apps and technology have never reduced the UK’s business failure rate. That didn’t sit well with us, so we designed SlideBy to help small businesses predict and control their financial future.

Watch our short video to hear why Stock Florist’s Owner, Sam, uses SlideBy to stay on top of her business’s cash flow and find balance throughout her busy work/life schedule.

FREE to Download - no hidden extras

SlideBy is Designed for Your Business

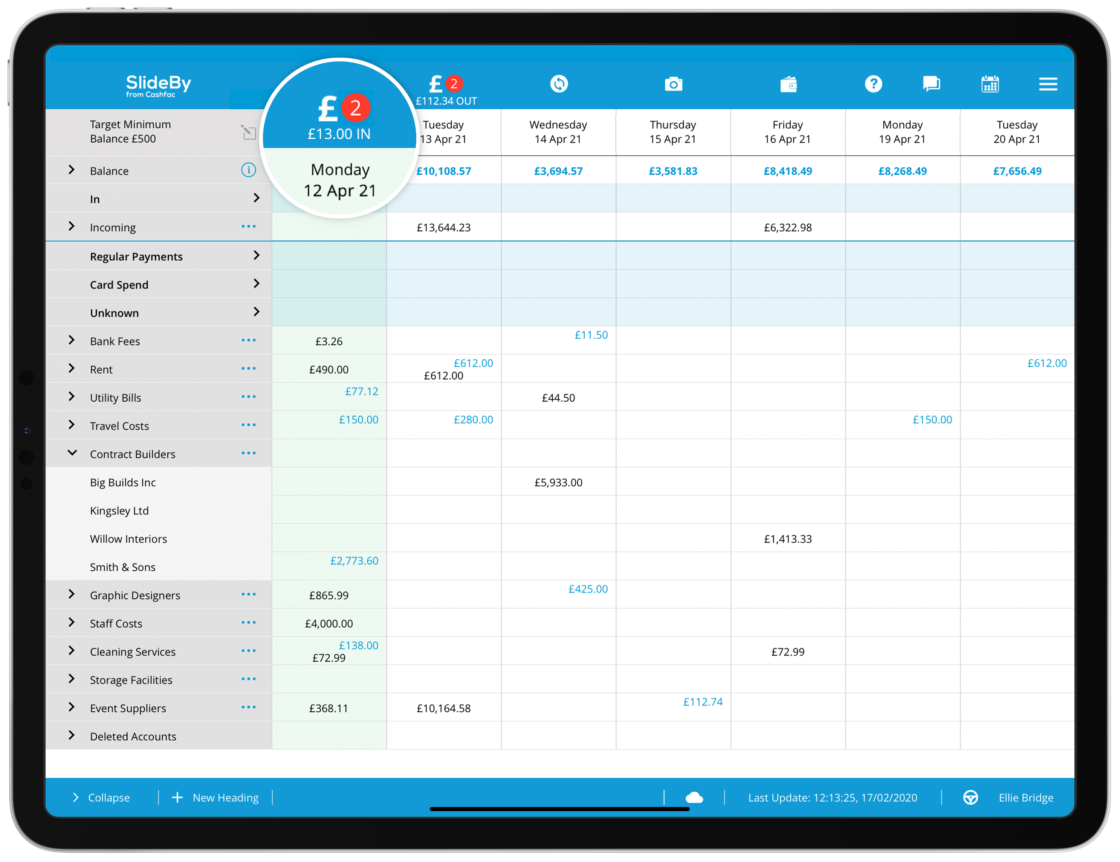

SlideBy helps you cash manage your business. Your income and expenditure headings can be tailored and mapped to your own business’s customers and suppliers.

-

Specify suppliers, utilities and service providers

-

Add, delete and re-order your headings

-

Manage multiple bank accounts, businesses and users

SlideBy is designed for your lifestyle

We understand small businesses typically spend more time on their customers, suppliers and products than managing their cash. SlideBy is designed to be used anywhere and on-the-go to fit your timetable.

-

Dip in and out - anywhere, at any time.

-

See money as it comes in

-

Tweak your cash flow

Manage your customers & other income

SlideBy shows payments history and unpaid amounts by supplier and by customer so that you’re always ready for a conversation about payment.

-

Use SlideBy to see when a customer has paid you

-

See when you're due to be paid next and how much

-

Use forecasted income to manage your expenditure

Manage your suppliers and other expenditure

See who you’ve paid, when you paid them and the amount you paid. Slide right and your forecast tells you what you can expect to pay in the coming days.

-

Identify when cash is going to become tight

-

Slide invoices to delay a supplier payment

-

Make a part-payment to a supplier (coming soon)

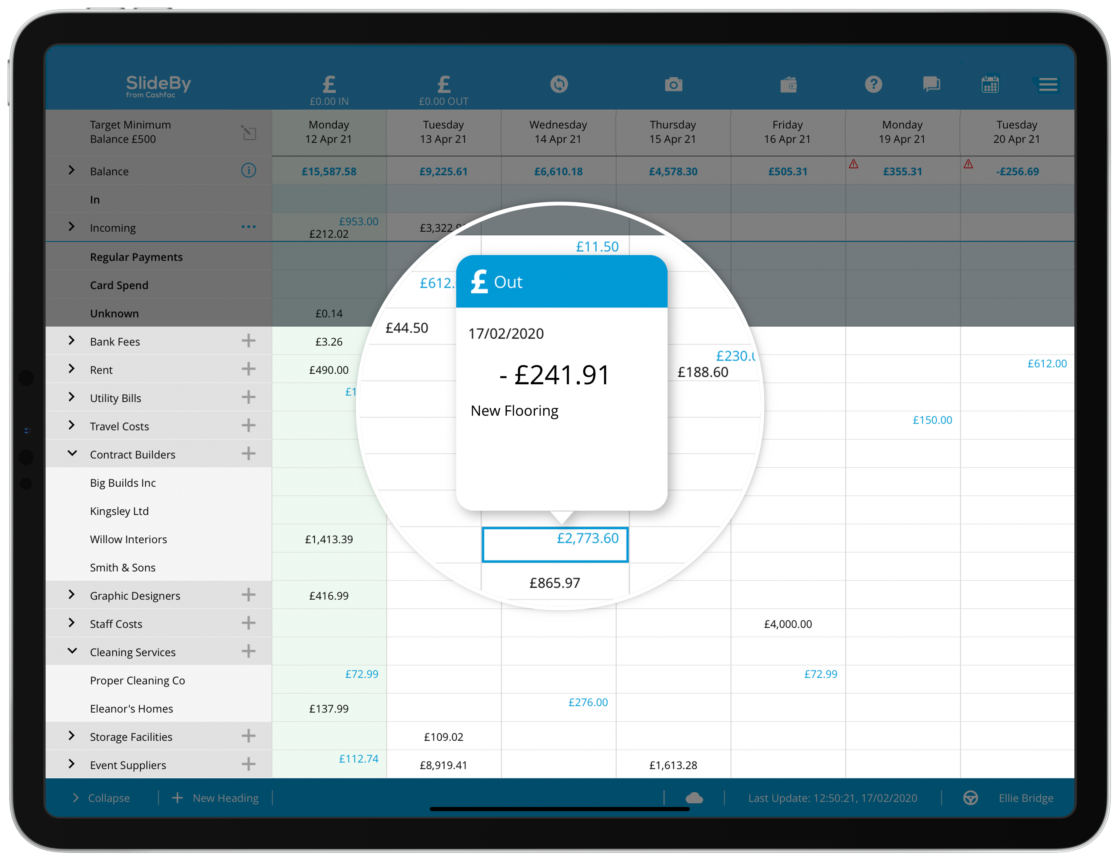

Control Your Future Bank Balance, Today

Use SlideBy to make informed decisions on customer and supplier payments central to your cash flow. Simply look at your payments and balance history (slide left) and future cash position (slide right).

-

Make or delay payments (feature coming soon)

-

Make informed, smart financial decisions

-

See the instant impact of deciding when-to-pay